Written by: Bar Galanti

How to start

Firstly, check if you already have a credit score. Each individual is entitled to one free copy of his credit report every 12 months from each of the main credit bureaus Equifax, TransUnion, and Experian. Secondly, start a free account to start monitoring your credit rating. A quick and easy way is to download an app such as CreditKarma or NerdWallet, which both can provide you with free credit score information and financial tools. Another option, you can apply for a credit card through any financial institution. Lastly, people with low scores could apply for a secured credit card. Therefore it allows you to back your card with cash and use it and pay on time!

Why credit score is so important?

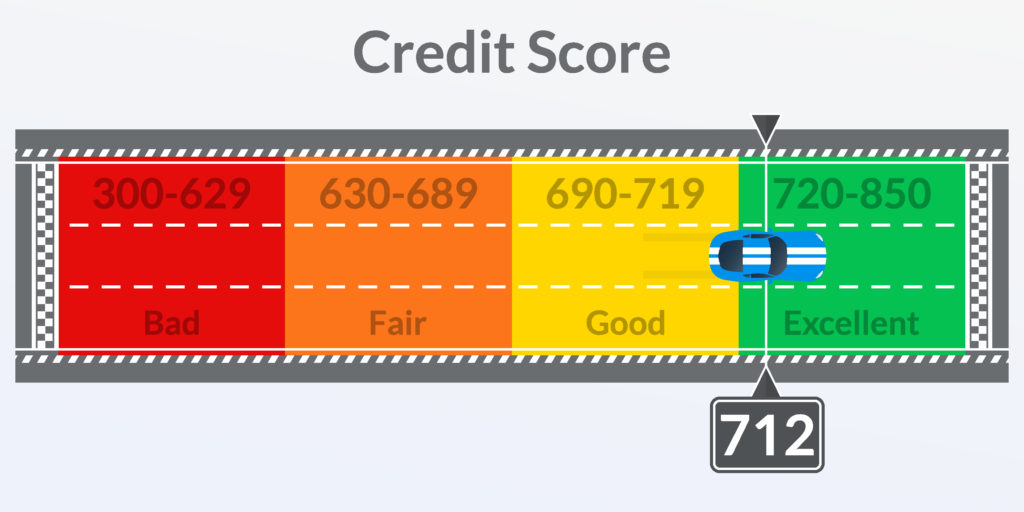

A credit score is an entire credit history translated into a three-digit number. A good score is essential since it will affect your chance to receive a loan for a house or a car, and it ranges go from 300-to 850 and have four ranking categories. The credit score is designed to assess the risk and likelihood of a borrower to pay his bills. Based on the score, your eligibility, your interest rate, and the amount of funding will be determined.

Components of credit report rating

Lenders use borrowers’ FICO scores along with other details on borrowers’ credit reports to evaluate credit risk. The main components and their weight for the report are:

Payment History 35%Total Debt 30%Duration 15%New Credit 10%Types of Credits 10%

Build your credit score

Your credit health can be tracked daily, it has a few factors that will help you stay on the right track. The most important is to pay on time! Do not miss a credit payment, since one late payment will drive your score down significantly. Credit utilization also has a great weight on your score as well, it is recommended to use no more than 30% of your credit card limit (under 10% is even better). Remember, this is the long-run game and once your credit age has a minimum of 1-year history it shows credibility. Multiple accounts can help your score grow faster but it is necessary to be responsible and not commit to something you cannot maneuver. Also, an option is to take a small loan that you can afford to pay each month and it will drive your score up and show creditors your reliable borrower.

Avoid debt collection, it will affect negatively your score and will remain on your report for years forward. And last, plan ahead and minimize your hard inquiries, have at least a year difference before applying for a loan.

A credit score is crucial for maintaining a healthily financial life. If you ever want to buy your dream house, buy your dream car, open your own business you would probably need a loan to start with. This means you need a credit score and a good one obviously!

“You cannot escape the responsibility of tomorrow by evading it today.”

~Abraham Lincoln~

Check out more tips for self-improvement on our website!

https://www.sophisticatedprofessional.com/uncategorized/how-to-become-the-best-version-of-yourself/